Insurance: Incentives (Part III)

A big-picture problem for U.S. healthcare markets: a closed system.

1. If I... could put time... in a bottle…

Prevention plays an important role in health and keeping costs down. Unfortunately, prevention’s costs are immediate, but payoffs have quite the wait time. (Anyone else agree with me in Mile 1 of your “back in shape” plan?). To reap its benefits of avoiding heart disease, diabetes, and a basketful of prescriptions, you need prevention inputs over a period of, say, 20-30 years. In contrast, how many years of coverage can you choose during annual (hint!) enrollment? Yep, only one.

2. Criminal Insight

This disconnect presents a problem. An insurer who covers preventive care in youth is unlikely to reap the rewards of this investment, which accrues slowly over the next 20 to 30 years. Although consumers (and likely the system as a whole) would be better off with strong preventive behavior, if consumers commonly move between insurers, the costs and benefits are no longer contained in one insurer’s business plan.

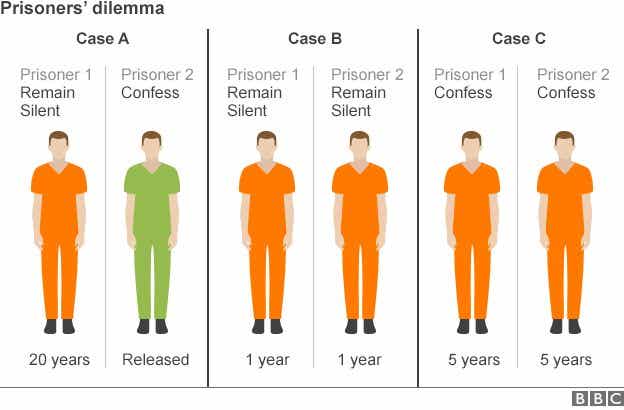

If you’re familiar with the “Prisoner’s Dilemma” (here’s my lecture version), you should identify an incentive to “defect” and let prevention be another insurer’s problem. Creating prevention-focused system is harder without a “closed system,” such as might exist in a fully public health care system.

3. The Wrinkle of a Private/Public System

The final wrench thrown in is that this poor incentive actually holds for ALL U.S. health care consumers. Just as those preventive actions would begin to pay off around age 65, Medicare is there to handle the bills for both insurers and patients.

Since there are also advantages to a mixed private/public system, what are options to address this? Recently, federal mandates on no-cost preventive care in contracts attempt to hit the insurer coordination problem. Alternatively, if consumers value preventive services, strong competition in insurance markets could also make these services more likely to be offered.

Read the rest of the insurance series: Why Does it (Really) Exist? (Part I), Insurer's Perspective (Part II), Rising Costs (Part IV)