Medi-wha?: Medicare Drug Plans (Part III)

Private insurers as task-managers for $111 billion in drug spending.

In Part II, we stumbled upon a promising new way to offer public insurance through private providers in Medicare Advantage. What if we applied those insights to $111 billion of Medicare pharmaceutical spending?[1]

1. Let them eat cake choice!

Medicare's introduction of drug coverage in 2006 was the biggest expansion of care since its inception in 1966. "Part D" is very popular, with 48 million people choosing drug coverage, or 77% of all Medicare enrollees. Studies found that Part D lowers enrollee's out-of-pocket costs and increases prescription drug consumption.[2] But besides enrollee health, what about fiscal health? What is new about Part D is how it departs from traditional government insurance provision. Unlike the services found in Medicare Advantage, drugs in Medicare Part D are entirely offered through private sector insurers.

Remember that traditional public insurance transfers new tasks onto the government 1: absorb fluctuating health risks, 2: create and manage pricing schedules, and 3: collect payment. By using private insurers in Part D, the government is shedding Task 2 (which they weren't awesome at), as well as some of Tasks 1 and 3.

For Task 2: create pricing schedules, the Centers for Medicare and Medicaid outline a standard enrollee benefit yearly. To offer a Part D plan, private insurers can offer exactly this standard benefit, or they can offer an alternative plan which is actuarially equivalent in its benefit value. This means a typical patient across different disease classifications would receive approximately the same benefits for approximately the same costs. Insurers can also offer enhanced benefit plans- which is a good idea because now there is competition. Other attractive Part D insurers could steal their enrollees. Plans can vary in benefit design, deductibles, cost-sharing, and spending management tools such as prior authorization and quantity limits. Private insurers who already offer Medicare Advantage plans ("Part C") can participate in both programs to provide hospitalization and physician benefits with additional drug coverage through a single plan, as an "all-in-one" for the enrollee.

For Task 3: collecting payment, the government pays private insurers 74.5% of the standard coverage for each enrollee, and the insurer charges premiums to collect the remaining 25.5%.

2. What we learn from doughnut holes.

The splashiest (though not tastiest) feature of Medicare Part D is the infamous "doughnut hole." It was so-called because, as you entered drug coverage in the standard government plan, you got yummy (generous) coverage levels. However, as you munched (spent) through your coverage year and hit a federally-defined spending threshold, the doughnut "disappeared" with little to no drug coverage. Yikes! After this large "hole," coverage would resume for catastrophic levels of drug spending.

Why do this? The idea was that enrollees would look ahead at the foreboding hole and plan accordingly- choose generics when they can, avoid unnecessary spending, etc. Unfortunately, as I explained from my own work, enrollees generally don't look ahead more than a few weeks, if any. This complex, changing pricing scheme is hard for enrollees to master in decision making. One study found that Part D enrollees considered premiums, the most straightforward piece of the puzzle, with 5 times more weight than other relevant out-of-pocket costs in a plan.[3]

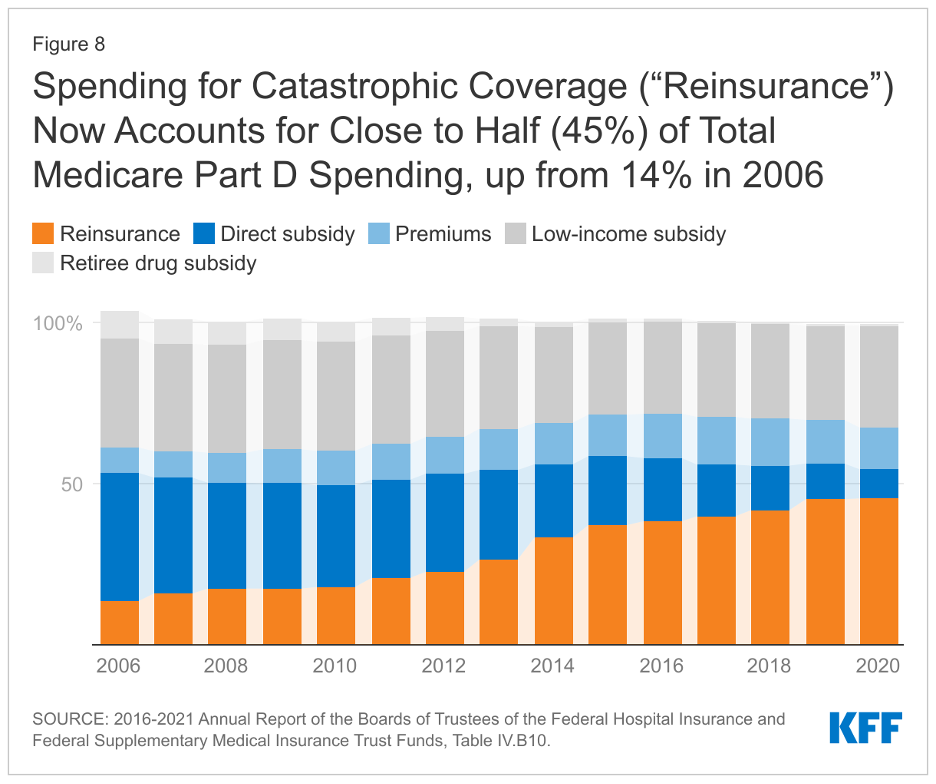

The doughnut hole structure also reveals the difficulties of Task 1: absorb fluctuating health risk. After the doughnut hole, very generous coverage kicks back in. If an enrollee spends a lot in this catastrophic region, the government picks up the tab from the private insurer for this "unusually" high risk outcome. These Medicare reinsurance payments, as they are called, were only 14% of spending in the inaugural year of 2006. In 2021, they have ballooned to nearly half of total Part D spending.[4] Government payrolls are now shouldering the challenges brought on by new high-cost drugs and overall increasing prices in pharmaceuticals.

3. Medicare Math

A, B, C, D. We've covered all the letters. Here is a summary of Medicare math on how these programs relate to each other and how enrollee choice works:

For standard coverage of hospitals and physician care:

A + B ≤ C. Traditional Medicare A and B are default coverage, but you can get the same or more benefits by joining Medicare Advantage, or "Part C."

For standard coverage plus drug coverage:

A + B + D ≈ C + D. You can add drug coverage as a "stand alone" Part D plan (called PDP) to either Traditional Medicare or to your Medicare Advantage plan.

A + B + D ≈ C + D ≈ C (including D). (Now this is some fuzzy math!). Finally, you can add drug coverage by choosing a Medicare Advantage plan which also includes the Part D benefits (MA-PD), with a premium that accounts for both sets of insurance coverage.

[1] "An Overview of the Medicare Part D Prescription Drug Benefit," Kaiser Family Foundation, October 13, 2021.

[2] Zhang, J.X., Yin, W., Sun, S.X. et al. The Impact of the Medicare Part D Prescription Benefit on Generic Drug Use. J GEN INTERN MED 23, 1673–1678 (2008) ;

[3] Abaluck, Jason, and Jonathan Gruber. 2011. "Choice Inconsistencies among the Elderly: Evidence from Plan Choice in the Medicare Part D Program." American Economic Review, 101 (4): 1180-1210.

[4] "An Overview of the Medicare Part D Prescription Drug Benefit," Kaiser Family Foundation, October 13, 2021.

Read the rest of the Medicare series: Medicare vs. Medicaid (Part I), Medicare Advantage (Part II), and Medi-caid (Part IV).